When most people think about applying for social security disability, they focus solely on their medical condition. But here’s the catch: many times, the Social Security Administration (SSA) denies applications before they even get to the medical review.

Why? Because of non-medical issues like income limits, missing documents, or insufficient work history.

According to the Social Security Administration (SSA), over 60% of initial disability applications are denied, and not always because of medical reasons. In fact, technical or non-medical issues are one of the leading causes of denial, things like incorrect paperwork, insufficient work credits, or exceeding work limits.

If you’re applying for Social Security Disability Insurance (SSDI) or Supplemental Security Income (SSI), understanding the non-medical requirements is critical. Let’s break them down and show how Nationwide Disability Representatives helps you navigate every step.

What Is Non-Medical Disability—and Why Should You Care?

Understanding the Difference Between Medical and Non-Medical Criteria

Your doctor might confirm you’re unable to work—but that’s just one part of the puzzle. The SSA also checks:

- Whether you’ve earned enough work credits (for SSDI)

- If your income and assets fall within the allowed limits (for SSI)

- Your citizenship or immigration status

- Whether you’re still working or earning too much at the time of applying

Missing just one of these requirements could cause your claim to be denied before your health condition is even considered.

Key Non-Medical Requirements You Need to Meet

The eligibility rules differ between SSDI and SSI. Here’s how they compare:

SSDI vs. SSI Non-Medical Requirements

| Requirement | SSDI | SSI |

|---|---|---|

| Work Credits | Required (based on age/work years) | Not required |

| Income Limit | Based on SGA: $1,550/month (2025) | $943/month for individuals (2025) |

| Asset Limit | No limit | $2,000 individual / $3,000 couple |

| Citizenship Requirement | Yes | Yes (stricter rules for non-citizens) |

| Employment Status | Cannot exceed SGA | Same |

Work Credits and SSDI Eligibility

For SSDI, you need to have worked and paid into Social Security for a certain number of years. The SSA uses a system of “work credits”—you can earn up to 4 per year.

Most applicants need 20 work credits (5 years of work) within the last 10 years. Younger applicants may need fewer.

Tip: If you’re unsure about your credits, Nationwide Disability Representatives can help you request your SSA work record and interpret it correctly.

Income and Asset Limits for SSI

SSI is for individuals with little to no income or assets. In 2025:

- Monthly income must be below $943 for individuals.

- Total assets must be under $2,000 (excluding your home and one car).

Common reasons for non-medical denials include:

- Receiving help from family (which counts as income)

- Having a second bank account you forget about

- Owning non-exempt property

Citizenship or Residency Status

You must be a:

- U.S. citizen, or

- Lawfully present non-citizen meeting specific criteria

Applicants on temporary visas, DACA status, or undocumented individuals generally don’t qualify, though there are exceptions for lawful permanent residents under certain conditions.

Substantial Gainful Activity (SGA) Limits

If you’re still working and earning more than $1,550/month (in 2025), the SSA may decide you’re earning too much to be considered disabled. For blind applicants, the threshold is even higher: $2,590/month.

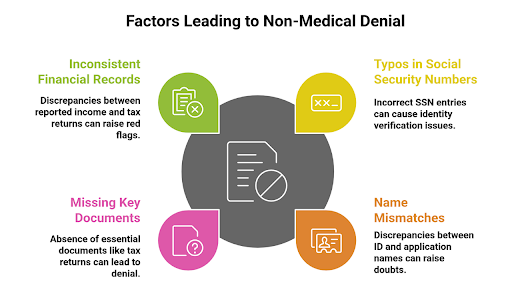

Mistakes That Can Lead to a Non-Medical Denial

Errors in the Application Process

Common oversights include:

- Typos in Social Security Numbers

- Name mismatches between ID and application

- Leaving out key documents like tax returns or birth certificates

Inconsistent Financial or Work Records

Discrepancies between your disability application and financial records can raise red flags during the review process. When your tax returns show income that contradicts your application, then you may face denial.

Frequent Non-Medical Errors That Could Cost You Benefits

| Error | Result |

|---|---|

| Missing or incorrect work history | SSDI disqualification |

| Income exceeds SGA threshold | Immediate SSI denial |

| Ineligible citizenship status | Application rejected automatically |

| Incomplete or wrong paperwork | Processing delays or technical denial |

| Late filing or appeal | Loss of rights to claim |

How Nationwide Disability Representatives Help You Qualify

35+ Years of Legal Experience

We’ve been fighting for disability claimants across the U.S. for over three decades. We understand SSA’s complex non-medical rules inside and out—and know how to fix issues before they cause damage.

No Upfront Fees, Ever

You never pay unless we win your case. There are no surprise costs, and the calculation is 100% free.

Full-Service Support

From application prep to appeals and hearings, we help you with:

- Gathering correct financial/work records

- Fixing errors in SSA documentation

- Appealing non-medical rejection

A Proven Track Record of Winning

Our team has recovered millions in benefits, including a $2.1 million settlement for a client with a traumatic brain injury. We’re here to help you succeed.

Simple Ways to Strengthen Your Non-Medical Evidence

- Get a copy of your SSA work history

- Organize bank settlements and tax returns

- Track your assets to stay within SSI limits

- Ensure consistency in everything you submit

- Speak to a legal expert before filing

Final Thoughts — Don’t Let Paperwork Cost You the Benefits You Deserve

You may qualify medically, but if your non-medical requirements for SSDI/SSI aren’t met, your application could be rejected without ever being fully reviewed. At Nationwide Disability Representatives, we make sure your application is complete. accurate, and fully compliant—the first time.

Call to Action:

Schedule your FREE consultation today and let us help you get the benefits you’ve earned. You pay nothing unless we win—and we’ve done it successfully for thousands of clients just like you.

FAQs Related to Qualifying for Disability Support

Can you be denied SSDI for non-medical reasons?

Yes. Even if you have a qualifying disability, you can be denied for insufficient work credits, excessive income, or missing paperwork.

What is considered substantial gainful activity (SGA)?

It refers to monthly earnings above a certain amount ($1,550 in 2025 for most applicants). If you earn above this, SSA may decide you’re not disabled.

Do green card holders qualify for disability benefits?

Yes, if they meet the SSA’s guidelines for lawful permanent residents and fulfill other eligibility criteria.

What happens if I don’t have enough work credits for SSDI?

You may still qualify for SSI if you meet the income and asset criteria, but SSDI will not approve your claim without sufficient work history.

Can I work part-time and still receive disability benefits?

Possibly. If your earnings stay below the SGA limit and the work doesn’t contradict your claimed limitations, you may still qualify.